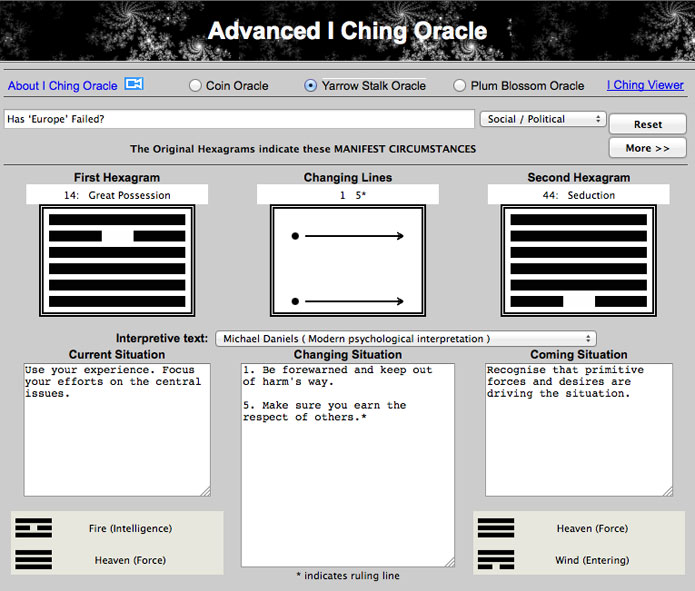

To get another opinion on the question posed in the New York Times Op-Ed, Has ‘Europe’ Failed?, which discusses the ethnic conflicts undermining an already shaky European Union, we turned to the I Ching for comment and found general agreement…

The first hexagram, Possession in Great Measure (from the Wilhelm translation), is one of success and even with the changing lines there is a clear guide to maintaining good fortune.

…there are many difficulties to overcome. It is only by remaining conscious of these difficulties that one can keep inwardly free of possible arrogance and wastefulness, and thus in principle overcome all cause for blame.

…benevolence alone is not sufficient at the time of Possession in Great Measure. For insolence might begin to spread. Insolence must be kept in bounds by dignity, then good fortune is assured.

If ‘Europe’ hasn’t failed yet, the second hexagram, Seduction (or Coming to Meet), marks an “unfavorable and dangerous situation” in which failure is suddenly an option. While the Daniels’ translation bids the EU to “recognise that primitive forces and desires are driving the situation”, the implication seems to be that if everyone would just be sensible for a moment, everything would be alright.

Might as well cross our fingers too…

[Reading via Psychic Science] [Previously on ACM – Ask the I Ching: Should We Break Up the Big Banks?]