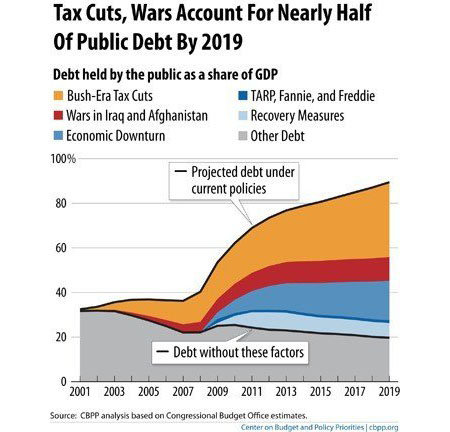

From Gresham’s Law:

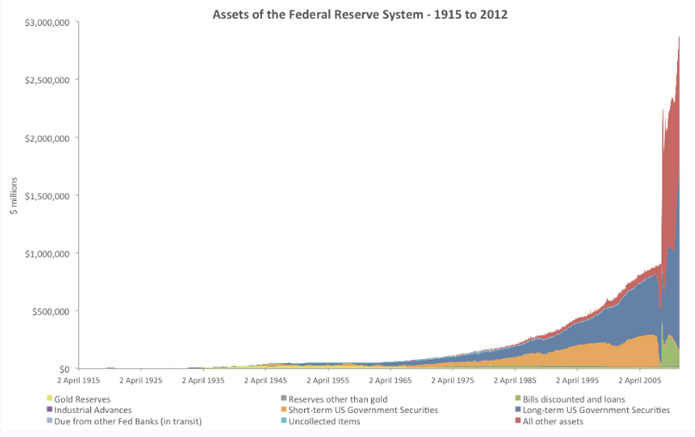

Here we present a history of the Fed in charts. As you’ll surely glean from the below — the Fed has degenerated from a by and large passive institution (dealing only in high-quality self-liquidating commercial paper and gold) to an active pursuant of junk, an enabler of wars, a ‘benevolent’ combatant of the depressions of its own creation, a central planner of employment & prices and of course a forgiving friend to inconvenient market follies.

If you understood any of that, you might enjoy the accompanying decade-by-decade survey of the Fed’s assets. Everyone else can join us in hoping that someone understood it.