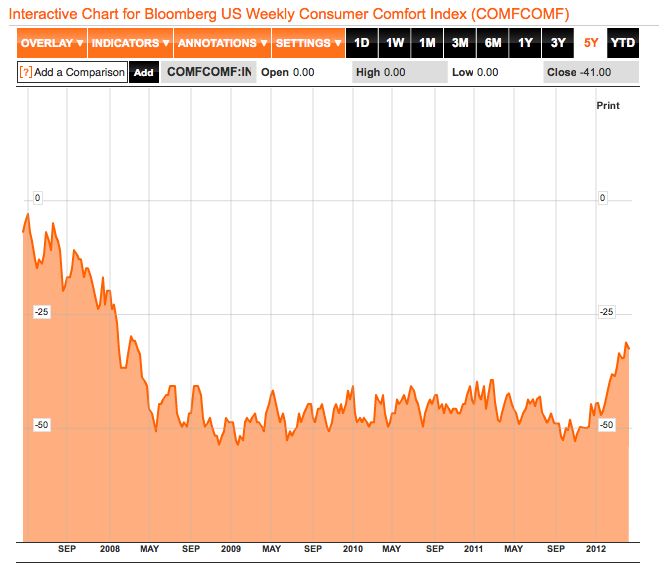

No one is happy with Bank of America. As their annual shareholder meeting draws to a close in Charlotte, NC today, four days of protests will be reaching their height while BofA’s stock continues to languish at lows it has not seen since the early 90’s.

There have been calls to stop doing business with Bank of America. There’s a petition and song about breaking up the bank. It was ranked #5 among America’s least reputable companies and named the second worst company in the country two years in a row. They tried to raise debit card fees, backed down from the resulting outrage, and yet are already working more fees back in. And now, as the possibility of their own credit rating getting a downgrade looms, their CEO’s pay has quadrupled…

Where do you even begin cleaning up that mess? An apology would be a start, but this one turned out to be a bit of economic fan fiction. Meanwhile, Bank of America continues doing business, such as being the largest financier of the U.S. coal industry, which earned their stadium in Charlotte a recent rebranding campaign.

Aside from generating 42% of the electricity produced in the U.S. during 2011, there’s not much good to say about coal either. If you’re tired of the usual laundry list of coal’s consequences, then maybe a report from Harvard pegging the best estimate of coal’s annual cost to the U.S. public at a third of a trillion, $75 billion in Appalachia alone, might be of interest.

The most alarming thought, however, is the simple combination of a desperate bank and a literally dirty business. If no one is walking away from money on a good day, Bank of America will likely be the last to admit that it’s $4.3 billion coal business is as toxic as it’s purchase of Countrywide, a contender for the worst deal in history. … That’s why they’ll probably need a little help.

If you’d like to join in breaking the news to them, there’s a protest going down, a petition going around and a good chance you haven’t heard the end of this story.

[Stock Chart from

Google Finance, Image from

Rainforest Action Network via

WeArePowerShift.org]

(click image to view zoom.it version)

(click image to view zoom.it version)